Aid and Your Bill

Your University Account

Your University Student Account is maintained by Student Financial Services. They provide assistance concerning student billing, account questions, and questions regarding administrative/late fees. They also handle all payments made to the University, disburse refund checks, and issue parking permits.

Student Financial Services offers the Time Option Payment Plan (TOPP) which allows you and/or your family members to make equal and consecutive payments throughout the term, rather than paying the total balance of the bill.

Financial Aid

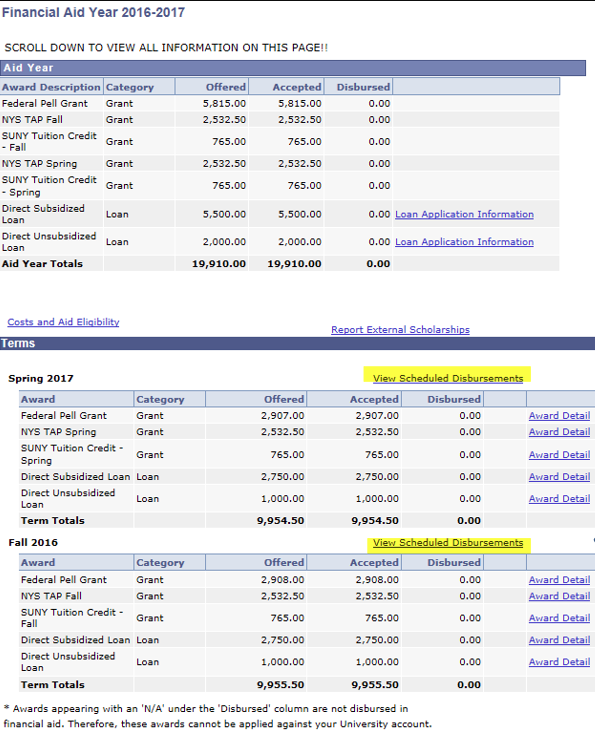

Financial aid that is either anticipated (expected) or already paid (disbursed) to your University account appears on your student billing account and is applied against your charges. Since you are responsible for ensuring that your University bill is paid on time each term (semester), you should monitor your student account, check your balance frequently, and become familiar with the way your financial aid appears on your account.

If you need help regarding options for covering a remaining balance, visit our "Filling the GAP" page.

- Your student account can be accessed through SOLAR under "CAMPUS FINANCIAL SERVICES - ACCOUNT INFORMATION/PAYMENT - ACCOUNT SUMMARY/WHAT DO I OWE?"

- Your bill itemizes the activity on your student account (i.e. charges, credits, financial aid, refunds) by term. To see this detailed information, you must click the term you wish to view.

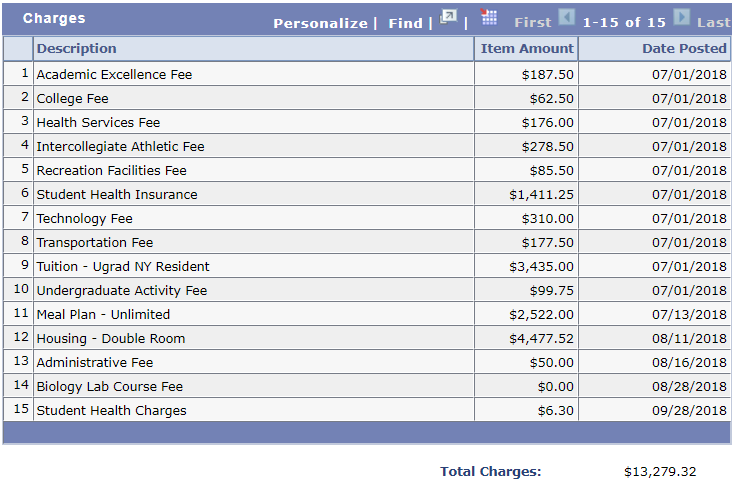

Charges: This section is a listing of the direct expenses you have been charged for the term. Expect to see things such as tuition, mandatory fees, and room & board if you live on campus. Indirect expenses such as books/supplies and off-campus housing do not appear on your bill.

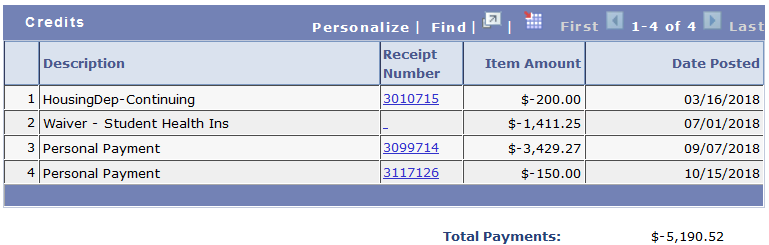

Credits: Provides a listing of personal payments and waivers applied to your account.

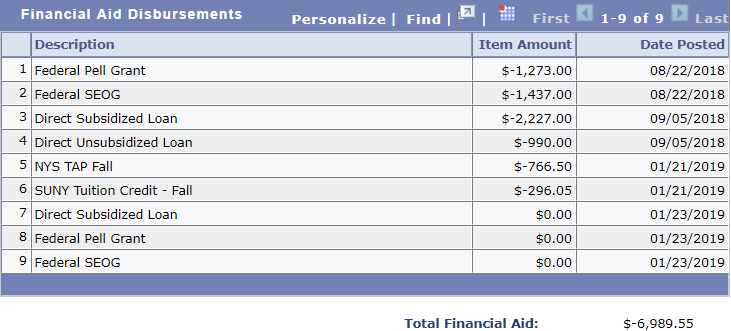

Financial Aid Disbursements: Displays the financial aid awards that have been applied to your account as payment. See "Disbursement of Aid" for more detail.

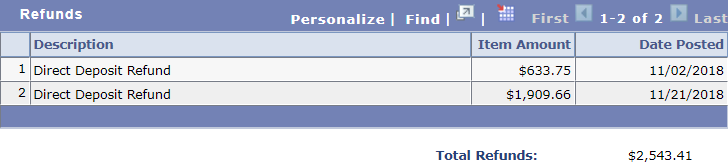

Refunds: Lists any account overpayments that you have been issued in the form of a refund. See "Account Overpayments (Refunds)" for more detail.

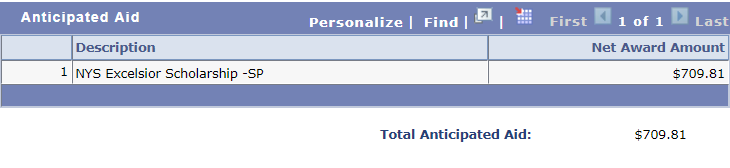

Anticipated Aid: Displays accepted financial aid awards that are expected to apply to your account as payment. See "Understanding Anticipated Aid" for more detail.Check your student account often! Certain events can change what you owe for the term and any unpaid balances can result in administrative &/or late payment fees:

- Changes in enrollment or award reductions can result in an open account balance

- Additional charges may be added to your account (i.e. changes in meal plan or housing, dorm damage, Student Health Center charges, etc.)

Note: The timing of billing and aid cycles may affect what you see when you view your student account. For example, a new freshman student is typically offered a financial aid package in mid-March but charges will typically not be added to the bill until mid-July (or until after Orientation, whichever comes later). If a new student views his/her billing information in July, he/she may see anticipated financial aid, partial charges, and possibly a credit balance on the account.

Because student bills are generated before financial aid disburses, anticipated aid is included to show you how much aid is expected and how much you will need to pay on your account balance after the anticipated aid is applied.

In general, anticipated aid is an award that you’ve accepted as part of your financial aid package. There are some awards that will not show as anticipated aid because they either do not disburse to your student account or do not impact your balance owed. Examples include:

- Award estimates – these will display in your financial aid package, but only actual awards count as anticipated against the bill (i.e. TAP and/or Tuition Credit estimates).

- Book stipends – when these funds are applied to the account as payment they are issued back to the student for use to purchase books and supplies.

- Federal Work Study and Work Stipends – these funds are paid directly to the student based on their employment arrangement.

- Student reported awards – only when actual funds from the awarding agency are received will they show on the bill.

Be aware: Changes in anticipated aid can affect the balance owed!

- Anticipated aid items that have not disbursed after a set amount of time expire and are no longer considered as pending credits to your account balance. Unpaid balances can result in administrative and/or late payment fees.

- Aid that has expired may still appear when viewing your aid on SOLAR under “My Financial Aid Awards”. If this is the case, you need to check your SOLAR ‘to do list’ for outstanding items requiring action (i.e. Verification, MPN, Entrance Counseling, etc.). If none appear, follow up with financial aid as to why the award has not disbursed to your account.

- Awards that have been cancelled due to eligibility changes are no longer anticipated and can cause an outstanding balance. Unpaid balances can result in administrative and/or late payment fees.

Financial aid funds that have disbursed (paid) are no longer anticipated on your account. Instead, they have applied as a payment to your account.

Financial aid is disbursed by term and is always first applied to the term for which the disbursement is made. Some awards are term specific and funds will apply to that term only. In other cases where disbursement creates an overpayment for the term, the excess funds are applied to prior/future balances.

Disbursement Schedule

Financial aid is paid (disbursed) to your student account approximately 5 days prior to the start of fall and spring terms. Disbursement runs every Monday, Wednesday and Friday mornings.

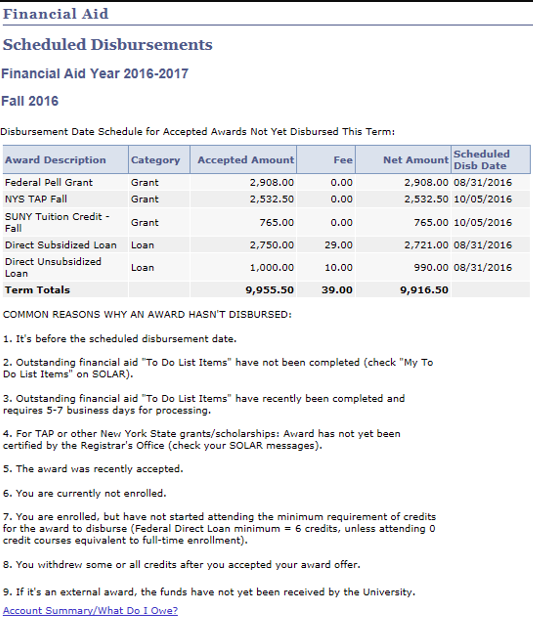

Each award you receive in your financial aid package has a scheduled disbursement date. You can view scheduled disbursement dates on SOLAR for accepted aid that has not yet disbursed by accessing the “View Scheduled Disbursements” link.

"View Scheduled Disbursements" link is only available when accepted aid has not yet disbursed to your student account for the term.

The scheduled disbursement date displayed is the earliest date for the award to disburse. If you have outstanding requirements to fulfill, the disbursement of your aid could be delayed while also resulting in the expiration of anticipated aid.Requirements for Disbursement of Aid

In order for financial aid awards to be applied as payment to your account according to their scheduled disbursement date, you must be meeting some general rules:

- In most cases, outstanding SOLAR ‘To Do List’ items will hold disbursement of your aid. Check SOLAR periodically for outstanding requirements.

- Be enrolled in classes.

- Meet the minimum Federal/NYS Academic Progress requirements.

- If the award is from an external agency, the funds need to be received by Student Financial Services.

When payments to your student account exceed your charges for the term, the result is an account overpayment (credit balance). When this occurs, the excess funds are typically given back to you.

If you have a credit balance due to excess financial aid funds, your credit balance will be issued via:

- Direct deposit to your bank account. Direct deposits are processed Monday, Thursday and Friday of each week.

- Paper checks will be mailed to you. Paper checks are printed bi-weekly.

You are highly encouraged to enroll in direct deposit, as it is both faster and more convenient. You can enroll by logging onto SOLAR and navigating to Campus Financial Services > Account Information/Payment > Direct Deposit > Add Account > Complete the Page > Save.

- Keep your bank account information up to date! If your bank account changes or the number is incorrect, it could delay your refund.

Important Notes about Refunds

- A refund will not occur until all University charges have been paid for the term.

- Because refunds are not issued until after the term begins, you should be financially prepared to meet any non-University expenses at the start of the term.

- If you accepted a student loan, your refund is likely coming from excess loan funds. Carefully consider if you need those funds, as student loans need to be repaid. You can reduce or cancel your loan by completing the Student Loan Change Form or Parent Loan Change Form. If you wish to complete a loan change form, contact our office and an advisor will add the form as a To Do List item on the students SOLAR account. The form will allow you to indicate the specific loan you wish to reduce or cancel. The form must be completed before the end of the term. Be sure to sign the request and include your Stony Brook ID. You will need to check your account balance after the adjustment is made as you are responsible for any outstanding balance.

- If a balance remains on your student account, you are responsible for paying it even after receiving a financial aid refund.